This information will be used in the invoices to mark the right VAT amount and also later in your accounting.

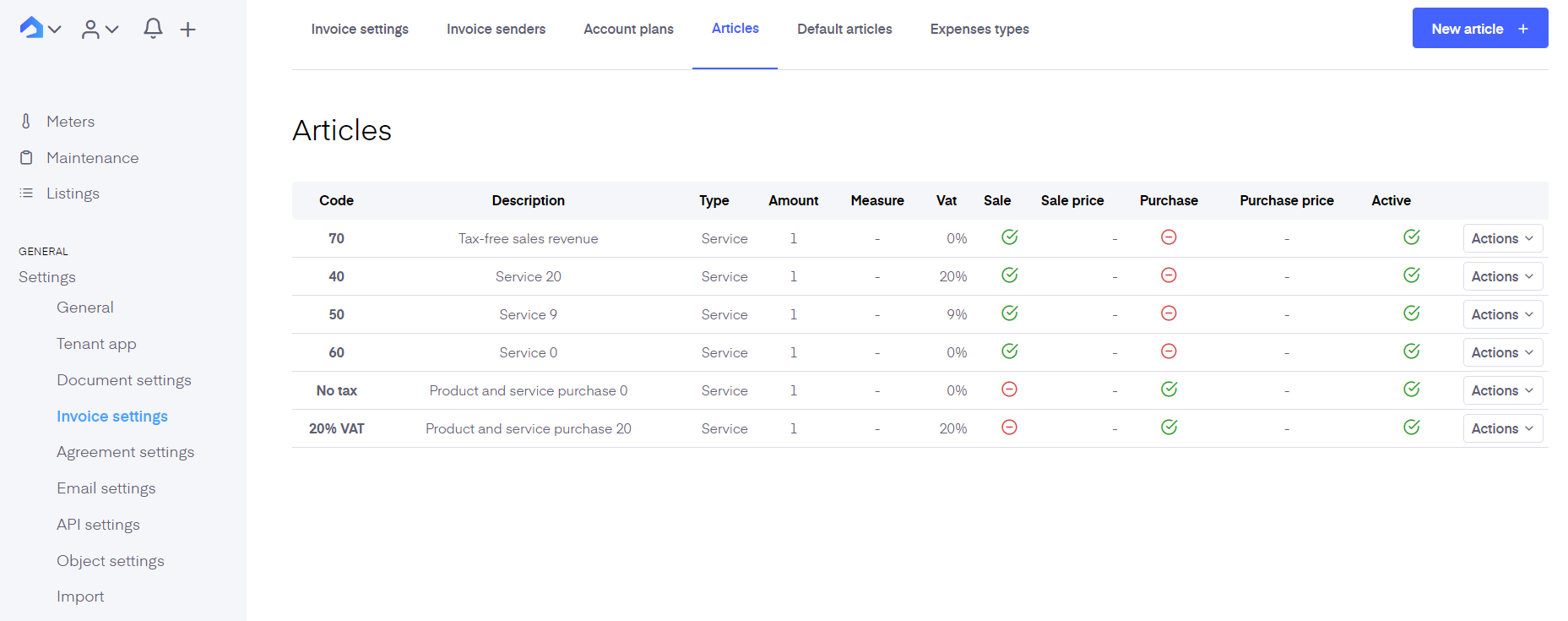

Here you can find some preset articles with the corresponding taxation percentage. These articles reflect the different VAT percentages you need for your invoicing. You can add additional articles to reflect your needs. There is no limit to articles. The articles will be connected with the services and define the tax rate of the service.

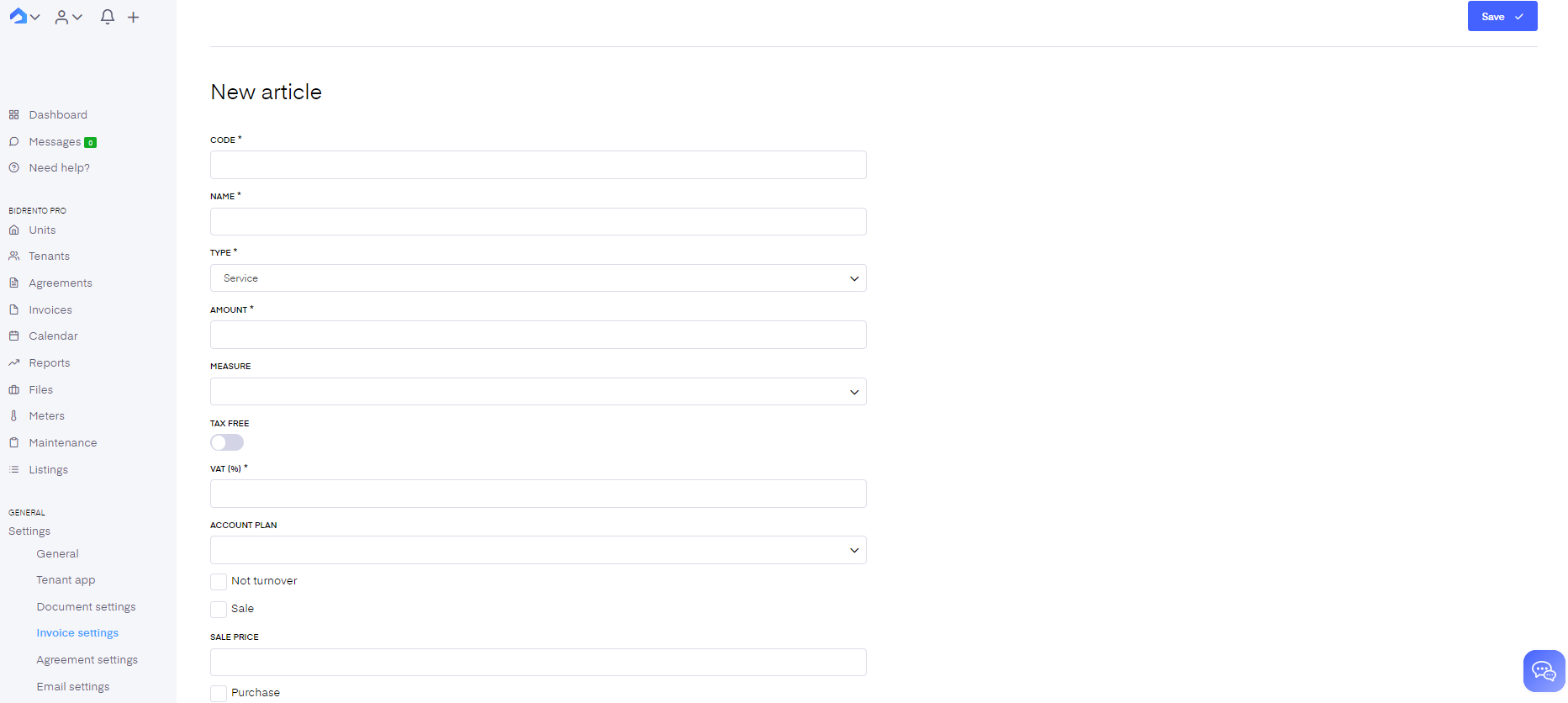

Click ‘New article’ to add a new article with new taxation. You can then fill out the fields manually.

If you use accounting Merit Tarkvara, Standard Books, or Smart Accounts you can connect them to Bidrento (more info here) and import existing articles from the software to Bidrento. The import can be done by clicking on the connected software under the ‘Connected services’. When you have the accounting software connected to the platform, the system automatically sends all the invoices to the accounting software and the accounting software is able to match the articles for bookkeeping purposes.

In case, you do not use one of the supported accounting software you can still do matching for bookkeeping manually. From ‘Invoices’ - ‘Overview’ you can download an XML file of all the created invoices (‘Generate invoices XML file’ button). That file can be uploaded to and is recognized on most accounting software. If you have added all the same articles to Bidrento that you use in your accounting, then the accounting software is able to automatically match all the invoices and articles for bookkeeping purposes.

Also, note that you can’t delete articles that are in use somewhere on the platform, in an agreement, invoice, etc. Articles that are in use can only be deactivated.