Bidrento can help you start collecting interest on arrears on your overdue sales invoices.

Activating interest on arrears

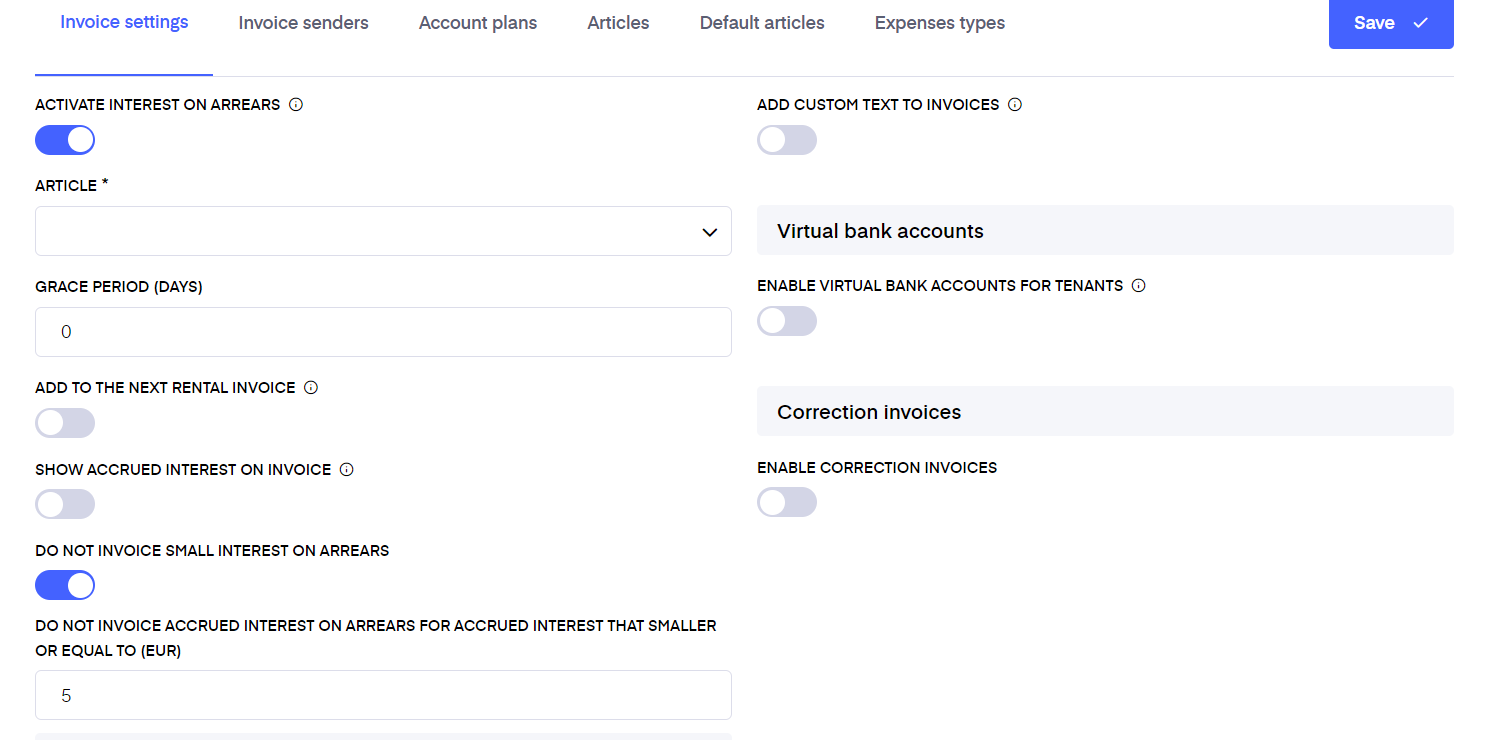

In order to switch on interest on arrears navigate to Settings > Invoice settings and switch on the "Activate interest on arrears" toggle.

After doing that you can decide which article you would like to use for the interest on arrears by choosing the right one from the dropdown.

You can also specify the grace period in days that you accept for overdue invoices before the interest on arrears starts accruing

If you would like the accrued interest of the overdue invoices to be automatically added to the next rent invoice once the initial invoice in debt gets paid, then switch on the corresponding toggle. Note that you have also the option to send a separate invoice for interest on arrears on demand. Read more about it below.

If you wish, you can set the small interest amount for which the tenant will not be invoiced for, by clicking on the "Do not invoice small interest on arrears" toggle.

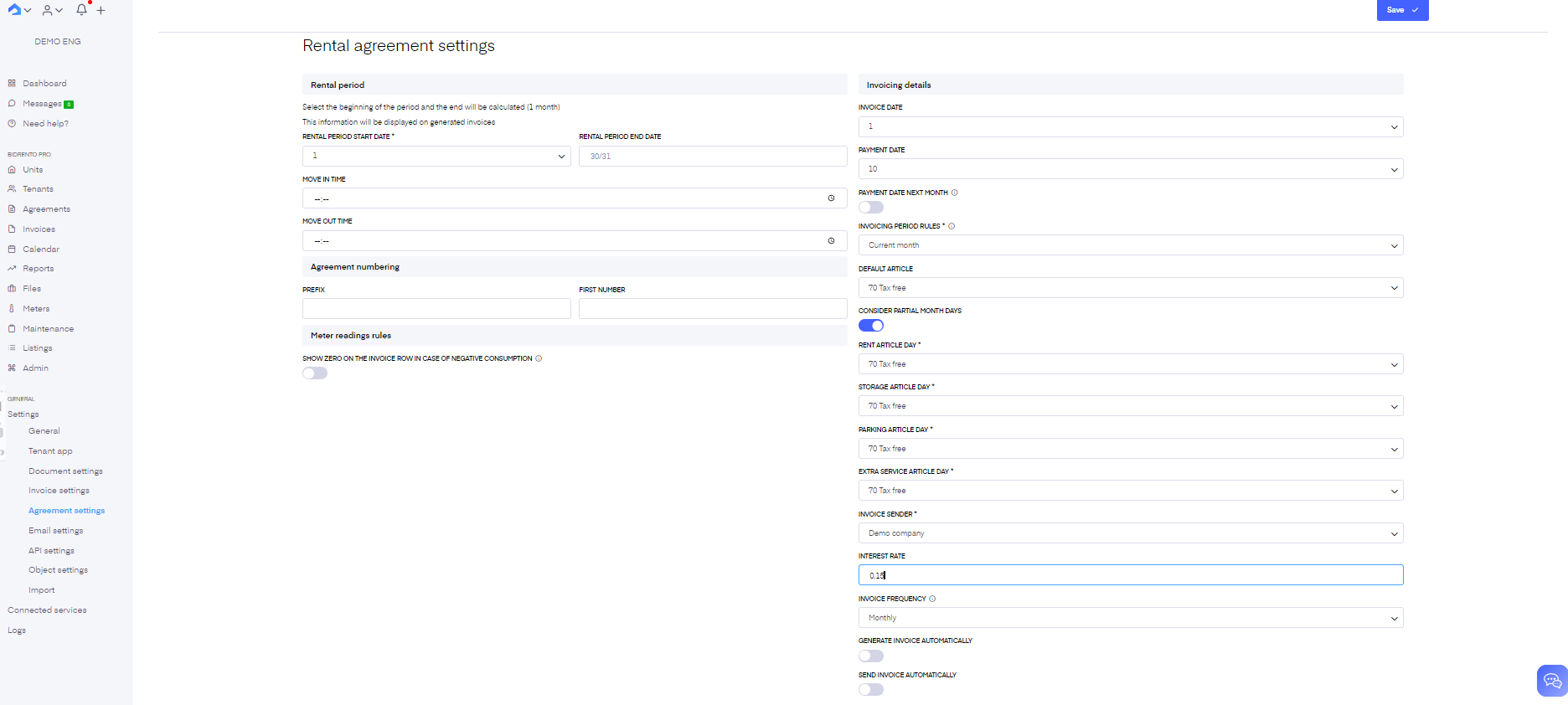

You can specify the interest rate (%) per day used in the agreements by default in the Rental Agreement Settings. The interest rate can be adjusted per agreement in the corresponding agreement edit view.

Overview of the accrued interests on arrears

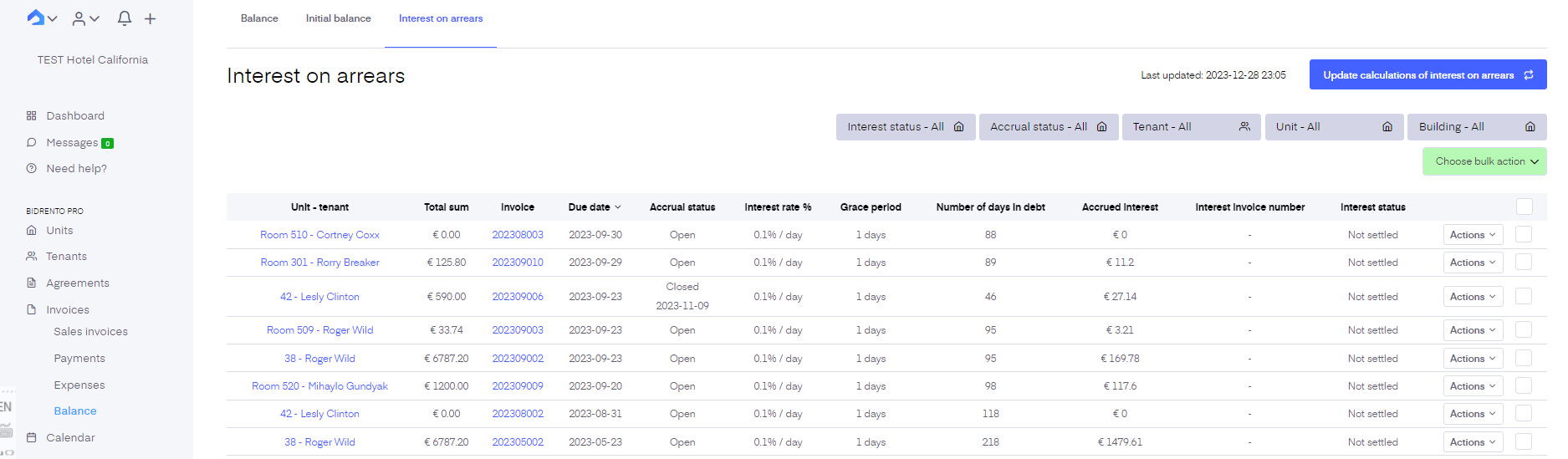

In order to get an overview of the accrued interests on arrears of your sales invoices please navigate to Invoices > Balance > Interest on arrears.

Please note that interest on arrears is recalculated once per hour. You can see the last update time next to 'Update calculation of interest on arrears' button. If you want to manually recalculate data on the page, please click on the 'Update calculation of interest on arrears' button.

In this view you can see all of your sales invoices that are either currently overdue and not paid or are paid, but past due date.

Property - tenant - the object and tenant associated with the sales invoices

Total sum - the total sum on the sales invoice

Invoice - the invoice number of the sales invoice

Due date - the due date of the sales invoice

Accrual status - "Open" means the initial overdue sales invoice is not settled yet and the interest is still accruing. "Closed" means that the sales invoice was fully paid on the date shown and an additional interest is not accruing. "Paused" means that interest calculation is paused by user.

Interest rate % - the interest on arrears rate of the sales invoice

Grace period - the grace period of the sales invoice

Number of days in debt - the number of days the invoice has been in debt after grace period

Interest - the total accrued interest on arrears amount

Interest invoice number - the number of the invoice on which the accrued interest is charged on

Interest status - "Not settled" means that the corresponding interest on arrears is not settled. "Invoice sent" means that an invoice has been sent out to settle the interest. "Settled" means that the interest has been settled

Total - at the bottom of the page the total amount of accrued interest for the shown interest calculations is visible

Note that an interest on arrears is marked as settled automatically when the invoice that was sent out to settle the interest gets paid.

From the actions menu you can...

- create an interest on arrears invoice on-demand. In order to be able to do that the original overdue sales invoice must be paid and the accrual status Closed.

- change the interest rate for the overdue sales invoice. Note that changing the interest rate here overwrites also the interest rate on the corresponding invoice.

- change the number of days in debt. This will overwrite the calculated days overdue.

- mark the interest on invoice as just settled.

- pause interest calculation

- resume interest calculation

- view interest calculation pause history

Once you create a separate interest on arrears invoice it will get listed in the Invoices > Sales invoices list view and you can send it out from there.

To obtain a detailed report about invoice interest on arrears calculation, please select the corresponding invoice and choose 'Generate report' from the bulk menu. The system will generate an Excel file with a detailed report, where each selected invoice will be represented as a separate tab in the Excel file.

From the bulk action it is also possible to generate invoices with interest rows for selected sales invoices by pressing the button "Generate invoice for interest on arrears". To perform this action, selected invoices should have an accrual status "Closed". After pressing the button, You have an opportunity to define the invoice date, the due date and the date of entry. Interest invoices are not generated for sales invoices in status "Open". Generated invoices will appear in Invoices -> Sales invoices -> Unsent.