The cost allocation module is the one that can be used to create utility bills. The distribution of utility costs is based on the building. This means that you can set the same or different cost allocation rules for all buildings in your portfolio. Based on these set rules, costs are regularly shared between all objects and tenants in the respective building.

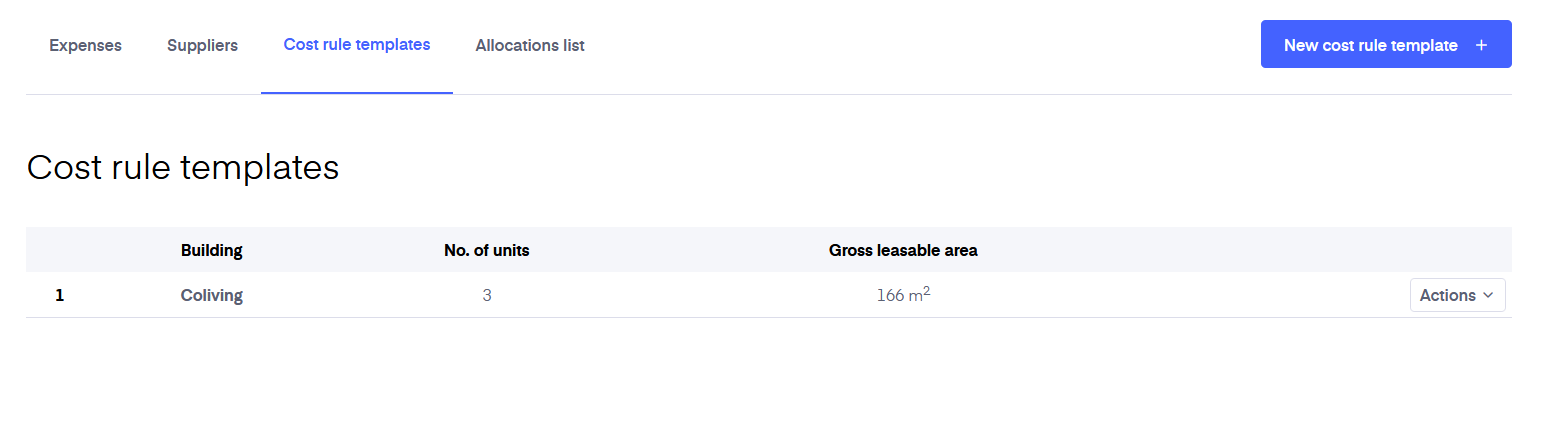

Before creating a cost breakdown, you need to create a cost rules template.

To create a new template, press the 'New Cost Rule Template' button in the "Cost Rule Templates" section and select the building for which you want to create it.

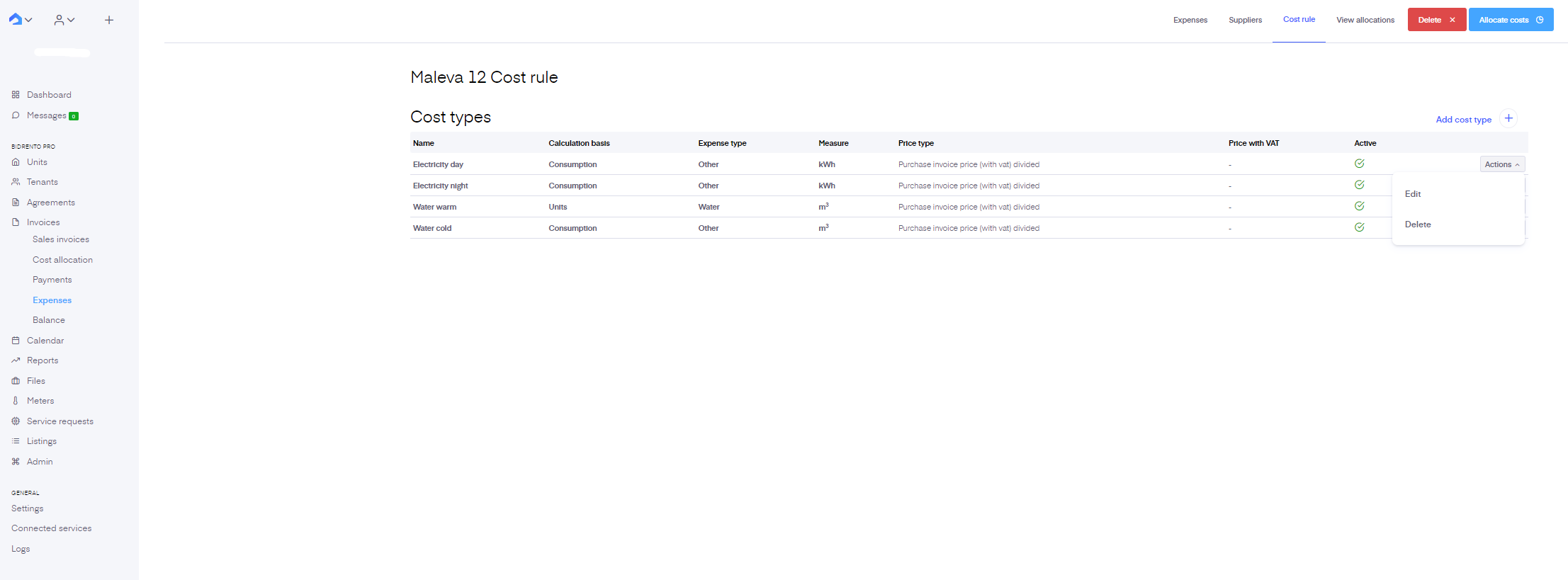

Next, you need to define the cost types of that building. Cost types can be for example electricity, which is calculated and split based on the actual consumption (meter readings) in one unit. Cost type can also be a general building maintenance cost. In this case, you can split the added purchase invoices between the units proportionally depending on the total area of the unit.

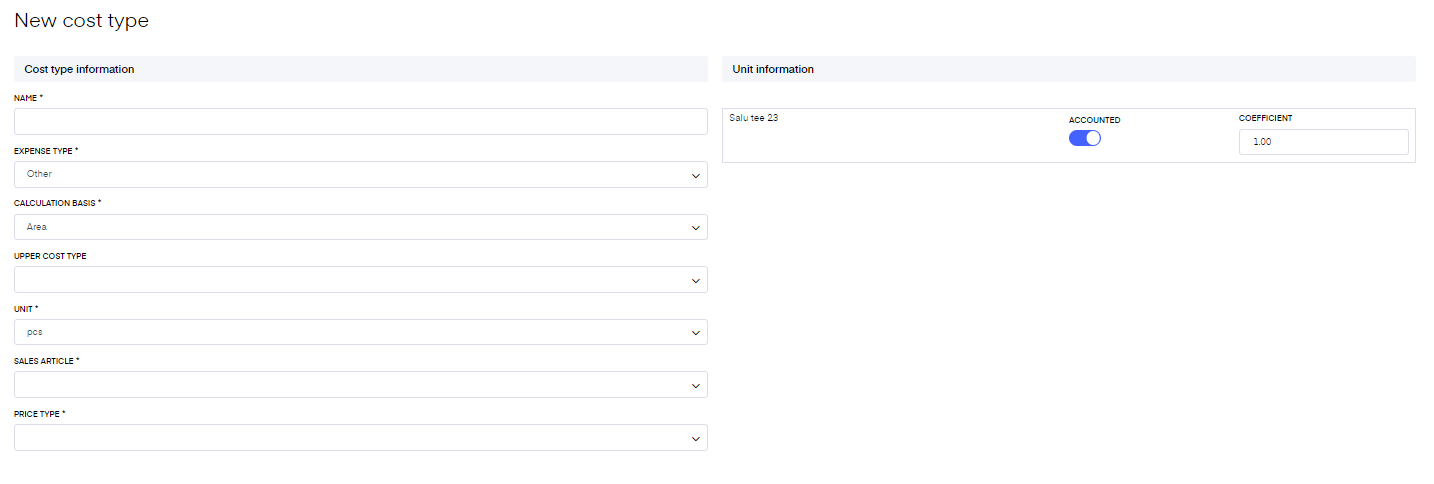

To add a new cost type click on the ‘Add cost type’ button and fill in the form.

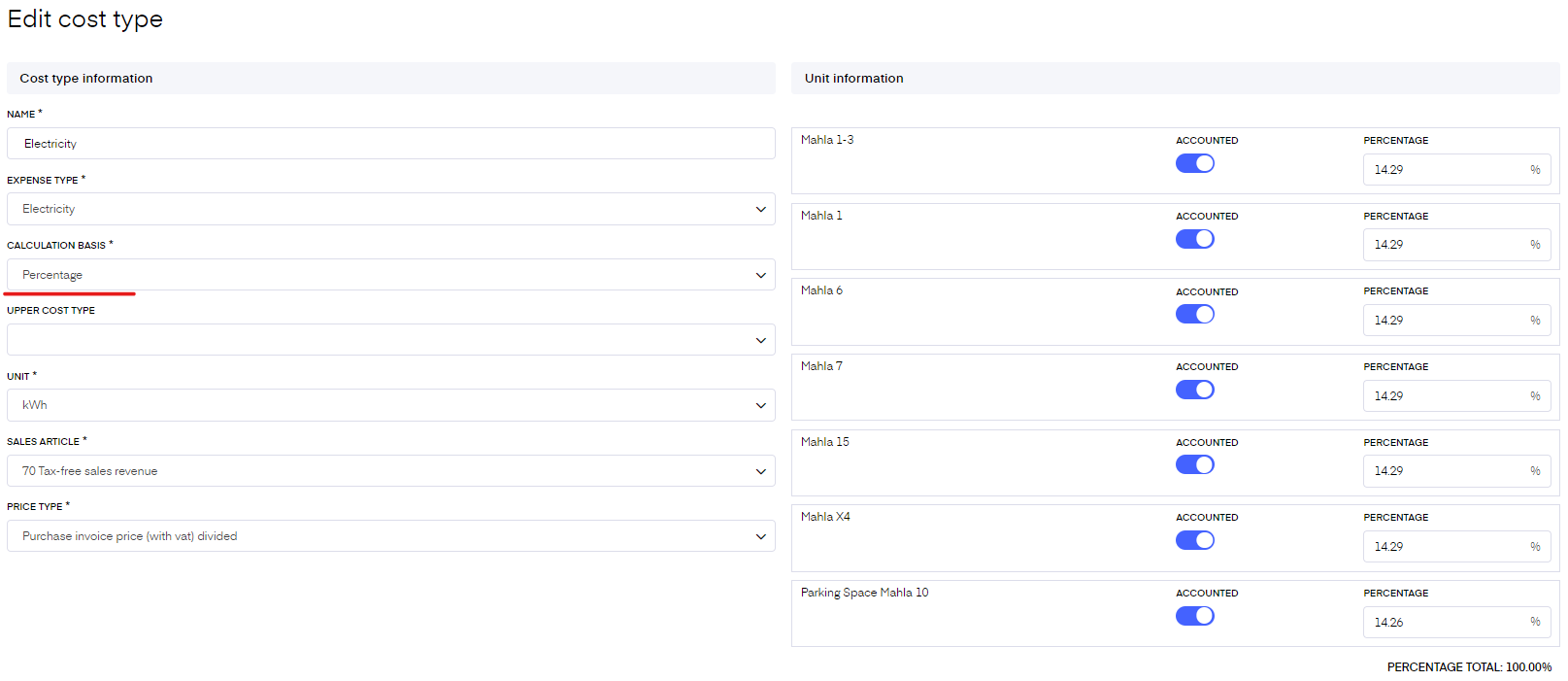

New cost type

Name - the name of the cost type (electricity, water, common electricity, etc.)

Calculation basis - select the principle based on which the costs are divided

Area m2 - the size of the unit

Units - number of all units in the building including apartments, parking spaces, storage, etc. Under ‘Unit information' (below) you can control which units are included in the calculation.

Consumption - consumption based on the added meter readings

Residents - number of residents living in each unit. The number of residents can be added under the 'Rental agreement'.

Upper cost type - this is used to calculate common costs in common areas in the building, costs which are divided between units (e.g. common electricity used in common spaces, such as the hallway, storage, etc. of the building). Upper cost type is the main cost which needs to have other costs subtracted from it.

For example, you receive an electricity invoice for your building which has a sum on it for the whole building’s electricity consumption. Now each apartment has a meter in its building that measures the apartment’s consumption (more info on meters here). To get common electricity you need to subtract from it the electricity actually consumed by the tenants based on their consumption, what is left over is the common electricity. This means you need to set up first a cost type for the common cost (e.g Common electricity), save it and then add the next cost type which will use the previous cost type as its upper cost type so that the lower cost type can be subtracted from the upper cost type.

In the ‘Cost rule’ overview you can see that the cost types subtracted from the upper cost type are connected to it as lower cost types. A detailed procedure is explained in the article below.

Unit - the unit of the cost which will be displayed on the created utility bill for the corresponding cost invoice row

Purchase article - the article of the corresponding purchase invoice, the article will be connected with the purchase and defines the tax rate

Sales article - the article used on the utility bill for the corresponding cost invoice row

Cost division type - if you selected the calculation basis to be ‘Consumption’, you have the option to either use each unit's consumption for the amount that gets split or the amount on the corresponding purchase invoice linked with the cost type

Price type - when splitting costs you can divide the amount using a fixed unit price or use the price on the corresponding purchase invoice. When you decide to use the fixed unit price, you have to enter the unit price in the ‘Price with VAT’ field.

Costs are not allocated for the following units: parking space, storage room and general use. If your building has a few different unit types and one of types the mentioned above is included, the system will skip this unit.

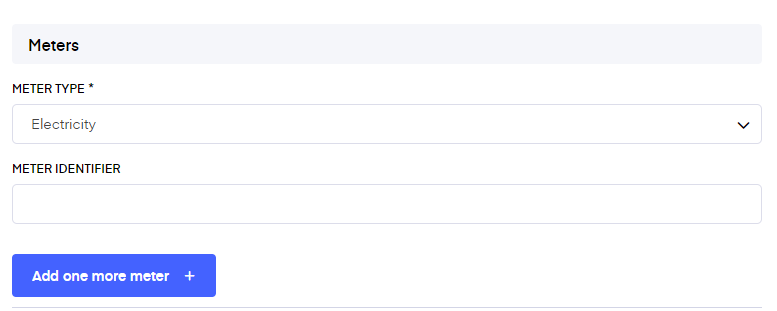

Meters

If you selected the calculation basis to be ‘Consumption’, then you have to select here the meter type(s) used for the cost type, e.g "Electricity day" and the corresponding Group meter ID, otherwise the allocation won't work. Meters need to be set up under the corresponding unit. Please note also that in order to get correct meter readings you need to have entered the initial meter reading.

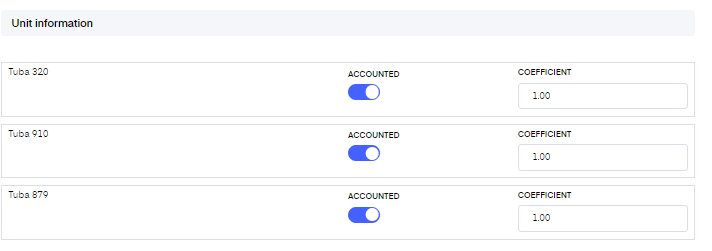

Unit participation

You can enable or disable a unit's participation in the cost allocation process. To exclude certain units in the building from this cost type, please uncheck the corresponding toggle for those units.

Additionally, you can control a unit's participation coefficient by adjusting the coefficient factor. A coefficient factor of 1 will allocate the full calculated cost to a unit, while any other value will multiply the calculated result by the provided coefficient. In case the coefficient is smaller than 1, the remaining part cannot be allocated as owner cost. In case calculation basis is chosen to be "Residents" and the unit is not covered with agreement, no owner costs will be created.

Another option is to set up percentages instead of coefficients. To use percentages you have to choose Percentage from "Calculation basis" dropdown. This option can be used only with Purchase invoice price type. By default, when the Percentage calculation basis is chosen the percentages are equally divided among the units of the building. The percentage should not exceed 100, otherwise the system won't let you save the page. The total percentage is found at the bottom of the page.

The total percentage should not be equal to 100%. If it is less, the remaining percentage will be allocates as owner cost which will be equally distributed among the participating units.

When the rule is applied, the system will calculate each allocated unit according to the following formula: purchase invoice sum * unit participation percentage.

Note: It is impossible to use Coefficient and Percentage option simultaneously for one cost type.

Deactivating and deleting existing cost types

You can delete any cost type that is not connected to purchase invoices. To delete a cost type just click on the 'Actions' button on their line and choose 'Delete', confirm, and done.

If the cost type is connected to a purchase invoice you cannot delete them, you can only deactivate them. To deactivate a cost type just click on the 'Actions' button on their line and choose 'Deactivate'. This will change their status from 'Active' to 'Deactive' and they will be moved to the bottom of the list.

Working with upper and lower cost types

1. Create an upper cost type(e.g. Common electricity), choose the calculation bases and choose the price type to be a purchase invoice price(with vat) divided.

2. Create a lower cost type, choose the calculation basis and in the Upper cost type choose the one created in Step 1. As a price type choose the Upper cost type price; cost division type: by unit consumption.

This means that the system will receive a bill for a certain amount and first, calculate (based on the consumption) the costs for every rental unit and afterwards split the difference based on calculation basis of the upper cost type.

Note: Meter readings should be added to the system

3. Go to expenses -> Add new expense and choose "Cost allocation". Enter the necessary information, define the amount of kWh spent(in case of electricity) and the price/sum of the bill.

4. Go to Cost rules and allocate the costs. You will see the columns - upper cost type and lower cost type. The system will show the calculations based on the division type entered in the rule. Now You are free to create invoices.

Advanced cost allocation

Also in Bidrento, you can make advanced cost allocation rules. For example: the ability to exclude/include an upper cost option on the expense invoice form. Gives the ability to allocate complex invoices for buildings with different cost structures.

In this case, if necessary, the system takes into account the invoice amount of the lower cost type in the calculation of the total amount of the upper cost type, so that the sums of the lower cost types are also taken into account when dividing the upper cost type.